Managing money could be intimidating when you’re just starting off. Many have issues with overspending, preserving little, or not knowing where their money goes each month. The good news is that mastering a few budgeting tips for beginners can significantly improve how you handle your income. With the perfect method, budgeting becomes simple, practical, and empowering.

In this guide, you’ll learn how to start budgeting for beginners, discover key budgeting practices, and comprehend essential financial guidelines for beginners that will help you develop a good financial foundation.

How to Start Budgeting for Beginners

If you’ve never created a budget before, the first step is to understand what budgeting really means. If you’ve never created a budget before, don’t worry—budgeting for beginners can be simple and practical. Budgeting is basically a plan for how you earn, spend, and save your money. It helps you stay in control of your finances and make smarter money decisions.

To start budgeting for beginners, follow these easy steps:

1. Calculate your total monthly income

Include your salary, freelance work, or any other regular income. Knowing exactly how much money is coming in helps you avoid spending more than you earn.

2. Track your monthly expenses

Write down all your fixed expenses like rent, utilities, and insurance, as well as variable expenses such as groceries, transport, and entertainment. Tracking expenses is one of the most important budgeting tips for beginners because it shows where your money is actually going.

3. Set simple and realistic financial goals

These could include saving a small amount each month, paying off debt, or building an emergency fund. Clear goals make budgeting more meaningful and motivating.

4. Choose a budgeting method that works for you

There is no one-size-fits-all approach. Beginners should focus on consistency and ease rather than perfection. Popular budgeting methods include zero-based budgeting, the envelope system, and using budgeting apps and spreadsheets.

Beginner-Friendly Budgeting Methods

Using simple budgeting techniques makes it easier for beginners to stay consistent and avoid burnout. Here are some of the most effective budgeting methods for beginners:

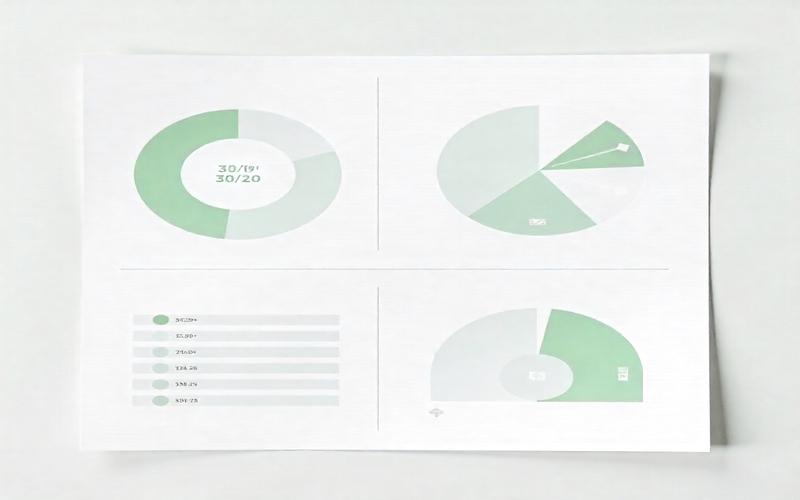

1. The 50/30/20 Rule

This popular method divides your income into three parts: 50% for needs, 30% for wants, and 20% for savings. It’s easy to follow and perfect for beginners who want a clear structure to manage their money.

2. Zero-Based Budgeting

Zero-based budgeting means giving every rupee a purpose. Your income minus expenses should equal zero, meaning you decide in advance where each rupee goes—whether it’s for daily expenses, savings, or loan payments. This method helps you track your expenses and avoid unnecessary spending.

3. The Envelope Method

A practical, cash-based technique where you divide money into envelopes for different categories like groceries, transport, or entertainment. Once an envelope is empty, you stop spending from that category. This method works well for beginners who find it hard to control overspending.

4. Budgeting Apps and Spreadsheets

Digital tools make it easier to track income and expenses automatically. Apps and spreadsheets save time and simplify budgeting, especially for beginners who want a stress-free way to manage their finances.

Budgeting Tips for Beginners to Stay Consistent

One of the biggest problems beginners face is sticking to a budget. These simple tips can help you stay on track over time.

Start small. Don’t try to fix everything at once. Pick one or two areas where you spend too much and work on improving them slowly. Small changes make a big difference in the long run.

Check your budget every week. A quick weekly review helps you see what’s going well and fix small issues before they become bigger problems.

Save automatically if you can. Setting up an automatic transfer to your savings account makes saving easier and reduces the urge to spend.

Stay flexible. Expenses can change, and that’s okay. A budget is not meant to limit you—it’s simply a way to understand and control your money better.

Beginner Budgeting Tips for Common Challenges

Many people think budgeting only works if you earn a high or fixed income, but that’s not true. Budgeting can help anyone manage money better, no matter how much they earn.

If your income is irregular, plan your budget based on the lowest amount you expect to earn. Any extra income can be used for savings or to pay off debt.

If you have loans or credit card dues, focus on paying the minimum amount first. As your income improves, slowly increase your payments.

For people with a low income, the best place to start is by tracking expenses. Look for small, unnecessary spending—saving even a little can make a difference.

Unexpected expenses will always come up. That’s why having an emergency fund is important. Even a small emergency fund can protect you from financial stress.

Common Budgeting Mistakes Beginners Should Avoid

Avoiding common budgeting mistakes for beginners can save frustration and keep you motivated on your financial journey.

1. Not Tracking Expenses Consistently

Without tracking your income and expenses, your budget becomes guesswork. Make it a habit to track expenses regularly so you know exactly where your money is going.

2. Setting Unrealistic Goals

Trying to save too much too quickly can lead to burnout. Start with small, achievable financial goals and gradually increase them as you get comfortable with budgeting.

3. Ignoring Irregular Expenses

Many beginners forget about annual subscriptions, repairs, or one-time payments. Planning for these irregular expenses prevents unexpected budget breakdowns.

4. Giving Up Too Soon

Budgeting takes time to master. Progress matters more than perfection. Stick with your plan, adjust when needed, and remember that consistency is key.

Financial Tips for Beginners Beyond Budgeting

Budgeting is just one part of managing your money well. These tips can help you build stronger financial habits.

Have an emergency fund. It helps you cover unexpected expenses without going into debt.

Save before you spend. Treat savings like a regular bill so it becomes a habit.

Avoid unnecessary debt, especially high-interest loans or credit cards.

Keep learning about money. Understanding personal finance helps you make smarter choices and stay financially secure in the long run.

Conclusion

Learning budgeting tips for beginners is one of the most important steps toward financial independence. By understanding how to start budgeting for beginners, using simple budgeting techniques, and applying practical financial tips for beginners, you can take control of your money with confidence.

Remember, budgeting is a skill that

improves with practice. Start small, stay consistent, and adjust as needed. The

The sooner you begin, the sooner you’ll see positive changes in your financial life.